3 Artificial Intelligence (AI) Stocks to Buy Hand Over Fist in January

2 min read

The artificial intelligence (AI) market exploded in 2023 and shows no signs of slowing. The debut of ChatGPT reignited interest in the sector and forced many to rethink what they thought was currently possible with the technology. As a result, countless companies pivoted their businesses to developing the industry.

Data from Grand View Research shows the AI market is projected to expand at a compound annual growth rate of 37% through 2030. That would see it hit annual sales exceeding $1 trillion before the decade’s end. That makes now a great time to invest in this rapidly expanding industry and potentially profit from its promising outlook.

Here are three AI stocks you might want to consider buying hand over fist in January.

1. Advanced Micro Devices

Advanced Micro Devices (NASDAQ: AMD) has an exciting year ahead, with plans to strengthen its role in AI by launching a new chip. The company will begin shipping its MI300X graphics processing unit (GPU) in 2024, designed specifically to challenge Nvidia‘s dominance.

Nvidia soared to the top of the market in 2023, getting a headstart as it snapped up an estimated 90% market share in AI chips. Its success in the industry highlighted how far chipmakers like AMD are behind when it comes to AI.

However, AMD spent the last 12 months refining its AI technology and it’s hoping to make a big splash in the sector this year. As the cost of AI chips rises, the industry is desperate for increased competition and alternatives to Nvidia. Consequently, AMD’s MI300X has support from firms across tech, with Microsoft‘s Azure announcing in December that it will become the first cloud platform to use the new GPU to optimize its AI offerings.

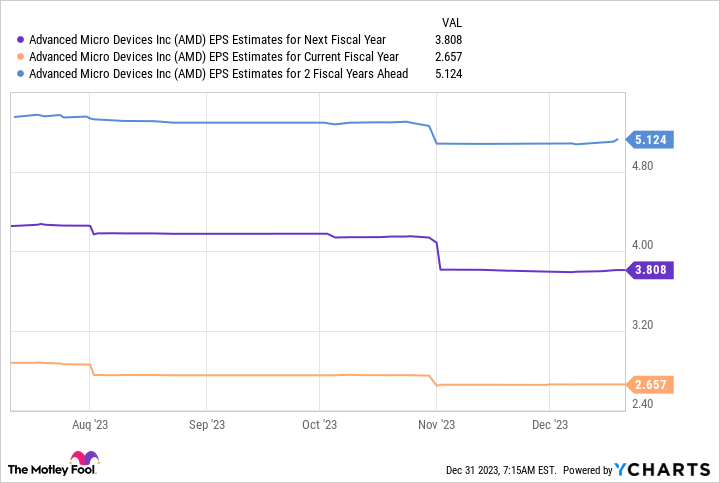

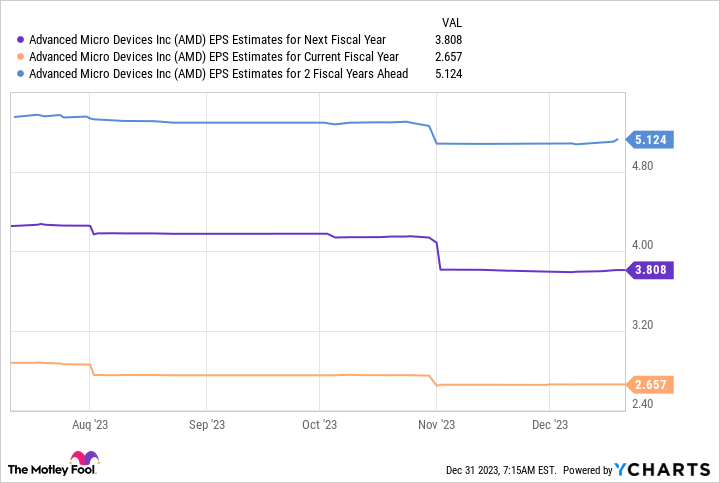

The chart above shows AMD’s earnings could hit $5 per share by fiscal 2025. When that figure is multiplied by the company’s forward price-to-earnings ratio of 55, it gives a stock price of $275, suggesting growth of 87% over the next two fiscal years.

2024-01-02 11:30:30

All news and articles are copyrighted to the respective authors and/or News Broadcasters. VIXC.Com is an independent Online News Aggregator

Read more from original source here…