3 Things All Retired Couples Should Know

2 min read

Social Security has been one of the most important social programs in the U.S. for decades. For retirement specifically, it provides vital income to millions of Americans across the country. After years of paying Social Security taxes, beneficiaries reap the rewards with a financial safety net of sorts.

However, these benefits aren’t restricted only to people who worked and paid taxes over the years. For example, Social Security allows spousal benefits to support non-working or low-earning spouses in retirement. For any couple that is nearing or in retirement and putting financial plans in place, here are three things they should know about Social Security spousal benefits.

1. How Social Security spousal benefits work

Social Security typically calculates a recipient’s monthly benefits using a formula that factors in their 35 highest-earning years of income. But a spouse can receive Social Security benefits based on their partner’s earning record if they’re at least 62 years old or caring for a child under 16 or with a disability.

Assuming the person claiming spousal benefits is at full retirement age, they’re eligible to receive 50% of their spouse’s primary insurance amount too.

For example, if spouse A’s earnings record gives them a monthly benefit of $2,000 at their full retirement age, spouse B could receive up to $1,000 monthly as well. The exact amount will depend on the age at which spouse B claims benefits.

2. The impact of claiming benefits early or late

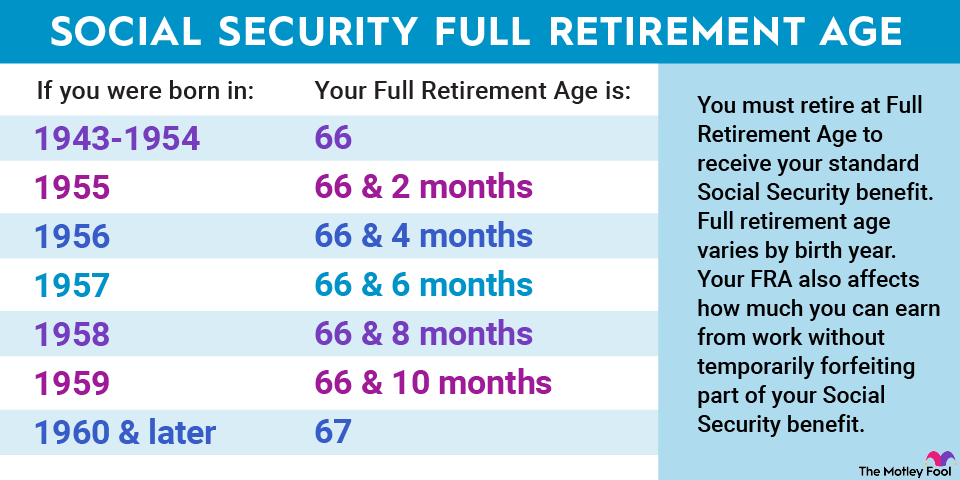

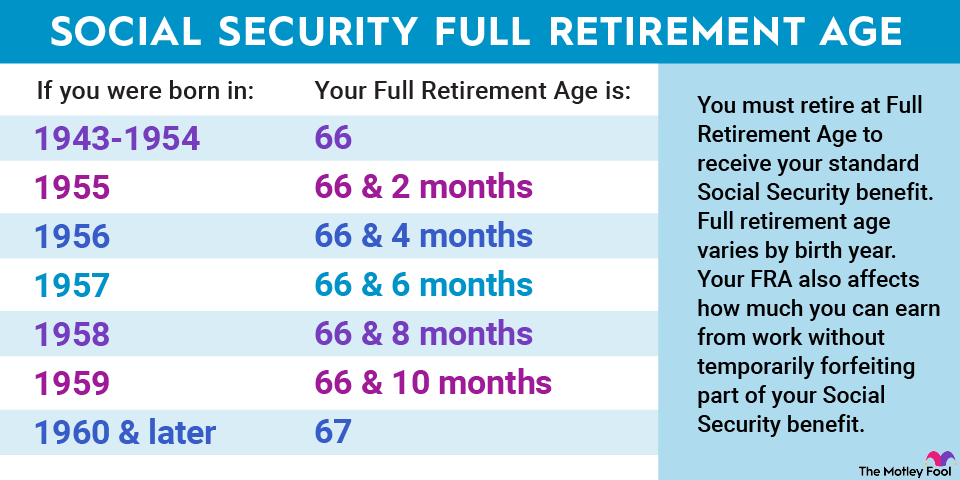

Your full retirement age is one of the most important numbers related to Social Security because it tells you when you’re eligible to receive your primary insurance amount. However, you don’t have to claim benefits at your full retirement age; you can claim them early (which reduces your payout) or delay (which increases your payout).

Claiming Social Security benefits early affects a spouse and their partner receiving…

2024-01-14 14:05:00

All news and articles are copyrighted to the respective authors and/or News Broadcasters. VIXC.Com is an independent Online News Aggregator

Read more from original source here…