Buy These 4 “Magnificent Seven” Stocks. Avoid the Others.

2 min read

Any investing exposure to the “Magnificent Seven” stocks has made your 2023 investing year a big success. This group of mega-cap tech stocks, including Nvidia (NASDAQ: NVDA), Amazon (NASDAQ: AMZN), Tesla (NASDAQ: TSLA), Apple (NASDAQ: AAPL), Microsoft (NASDAQ: MSFT), Meta Platforms (NASDAQ: META), and Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL), has outperformed the broader market despite the Nasdaq Composite surging over 45% last year.

If it’s not broken, don’t fix it… right? Well, not exactly. A look at the numbers signals that some of these genuinely magnificent stocks could soon run out of steam. Here are the four stocks in this group worth buying in 2024, and the three to leave behind in 2023.

1. Nvidia: Buy

Nvidia’s chips, which specialize in demanding, high-compute applications, have become a focal point of the artificial intelligence (AI) breakthrough. The company has quickly established dominance, controlling as much as 90% of the market for AI chips. That’s pushed the business to new heights, accelerating revenue growth to 200% year over year in its most recent quarter to $18 billion.

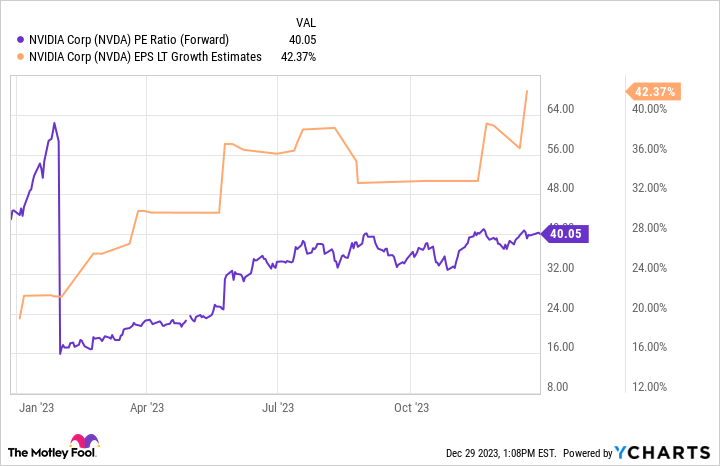

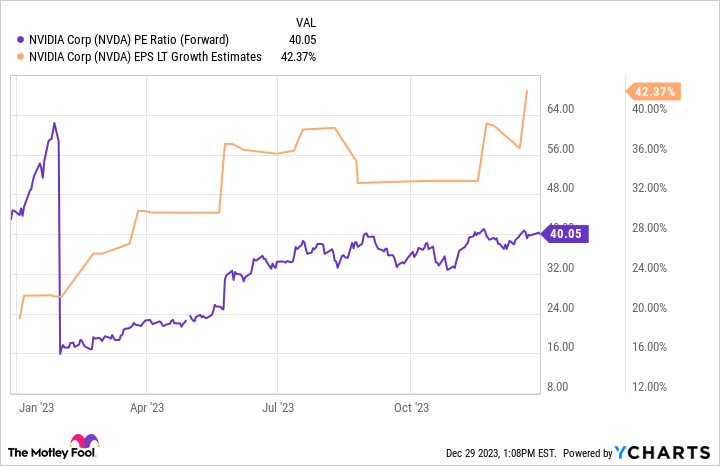

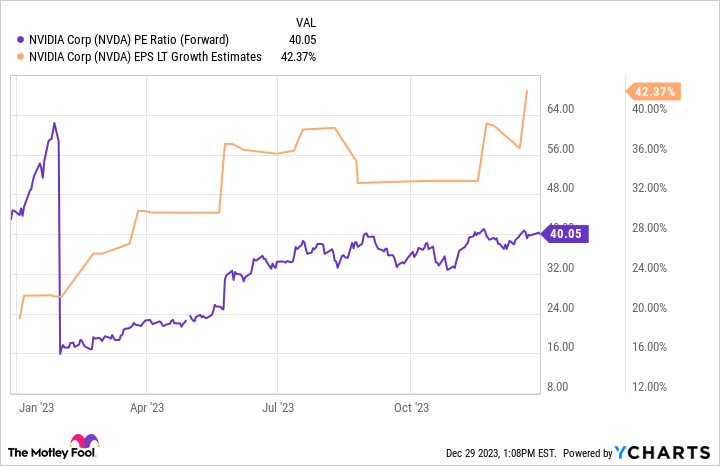

AI demand doesn’t seem to be going anywhere, which should create plenty of growth for Nvidia moving forward. Analysts believe the company’s earnings will grow by 42% annually over the coming years, arguably justifying Nvidia’s valuation at 40 times 2023 profits. That’s a PEG ratio of just 1, signaling the stock is still attractive despite its massive 250% climb in 2023.

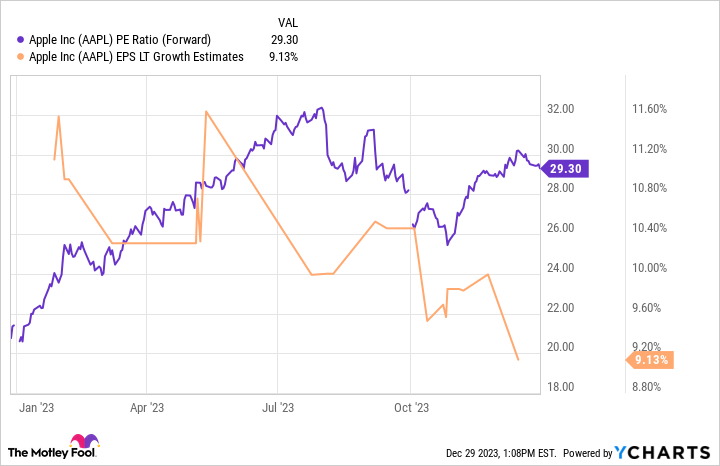

2. Apple: Avoid

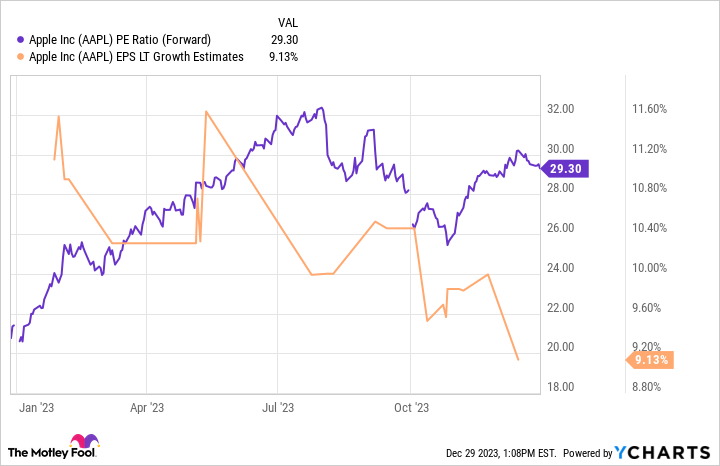

Not every “Magnificent Seven” company has grown enough to keep up with its stock. Apple’s revenue has fallen over the past year, and net income is up just 1%. Apple’s business can be cyclical, gyrating between periods of growth depending on key iPhone releases. That’s fine, but it can complicate things when share prices and operating results go in different directions.

Analysts have lowered their growth expectations for Apple moving forward….

2024-01-01 08:21:00

All news and articles are copyrighted to the respective authors and/or News Broadcasters. VIXC.Com is an independent Online News Aggregator

Read more from original source here…