Got $3,000? 2 Tech Stocks to Buy and Hold for the Long Term

2 min read

One of the more important qualities an investor can have is patience. The stock market is volatile, and even great companies see their stock prices go through down periods. What’s important, though, is the long-term value you receive.

If you have an emergency fund saved and high-interest debt paid down, here are two stocks in which you should consider investing $1,500 each as part of a diversified portfolio. Each has had its fair share of problems but is built to return long-term value. Investing in these two companies can expose investors to consistent income and growth opportunities.

1. AT&T

AT&T (NYSE: T) is one of the premier telecom companies in the world even though its recent stock price struggles might not suggest it. In the past five years, the stock is down over 21%, but the past six months have been more positive with the stock up 23%.

Investors have been pessimistic toward AT&T for a while, but the company seems to be turning the corner and refocusing on its wireless and fiber businesses. There isn’t high growth in the wireless business because the market is highly saturated, but fiber can be a growth area for AT&T. It added 1.1 million fiber subscribers in 2023 and increased fiber revenue by 27% year over year. That’s something it can continue building on.

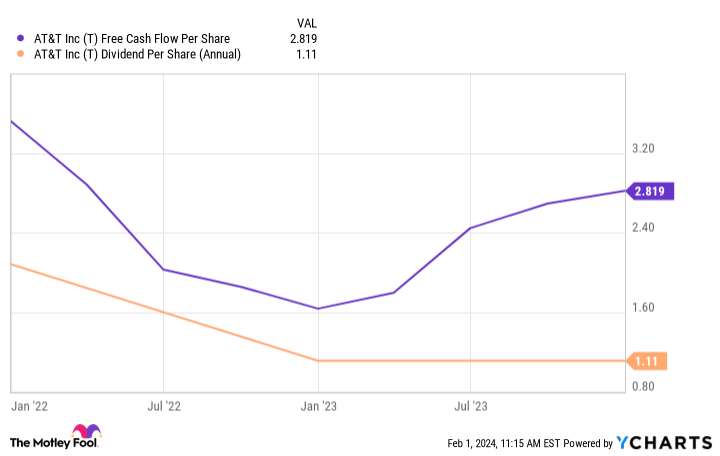

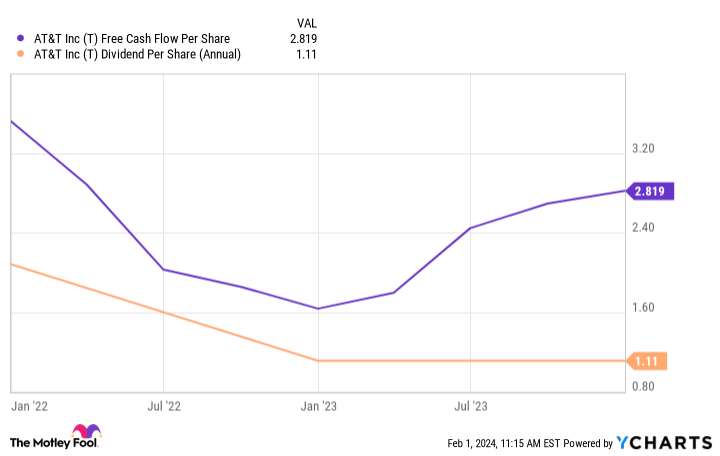

Investing-wise, there’s no doubt that one big appeal of AT&T’s stock is the dividend. It sports a 6.2% dividend yield of 6.2%, making it one of the highest in the S&P 500. For a while, AT&T’s high debt made investors question if the dividend would need to be cut, but AT&T’s free cash flow should put those questions to rest.

T Free Cash Flow Per Share data by YCharts

AT&T made $16.8 billion in free cash flow in 2023, up $2.6 billion from 2022, and more than enough to cover its dividend and debt obligations. With a 6% dividend yield, investors could expect $90 in annual dividends from a $1,500 investment.

2. Alphabet

With properties like Google, YouTube, and…

2024-02-05 14:10:00

All news and articles are copyrighted to the respective authors and/or News Broadcasters. VIXC.Com is an independent Online News Aggregator

Read more from original source here…