History Says These Stocks Are Ridiculously Cheap and Could Fuel Phenomenal Returns in the Future

2 min read

The S&P 500 has been scorching hot over the past year. The broad market index has rallied nearly 28%. That has it trading at an all-time high.

However, not all stocks participated in the rally. Energy stocks are up only about 1% over the past year, so the sector trades at a historically low valuation. That suggests energy stocks have significant upside potential during the next sector rotation.

Scraping the bottom of the valuation barrel

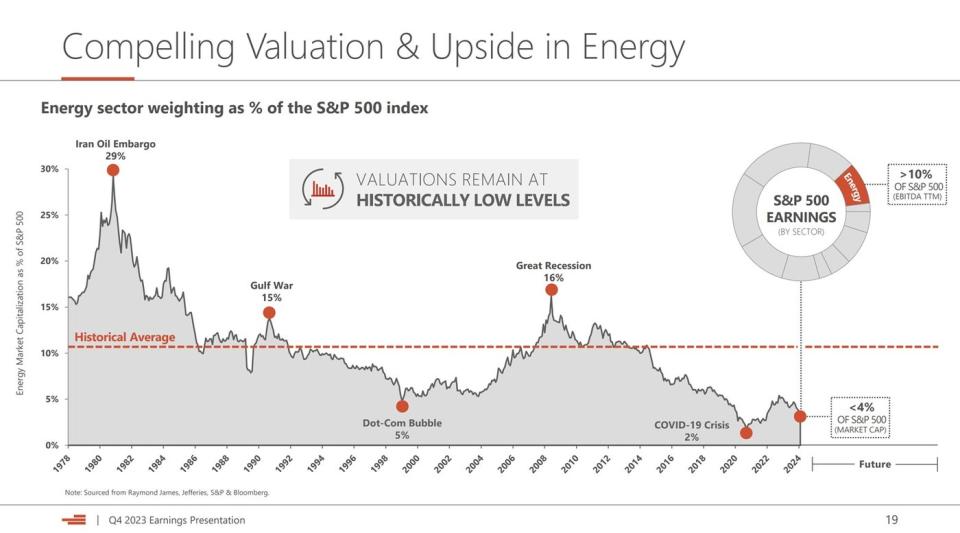

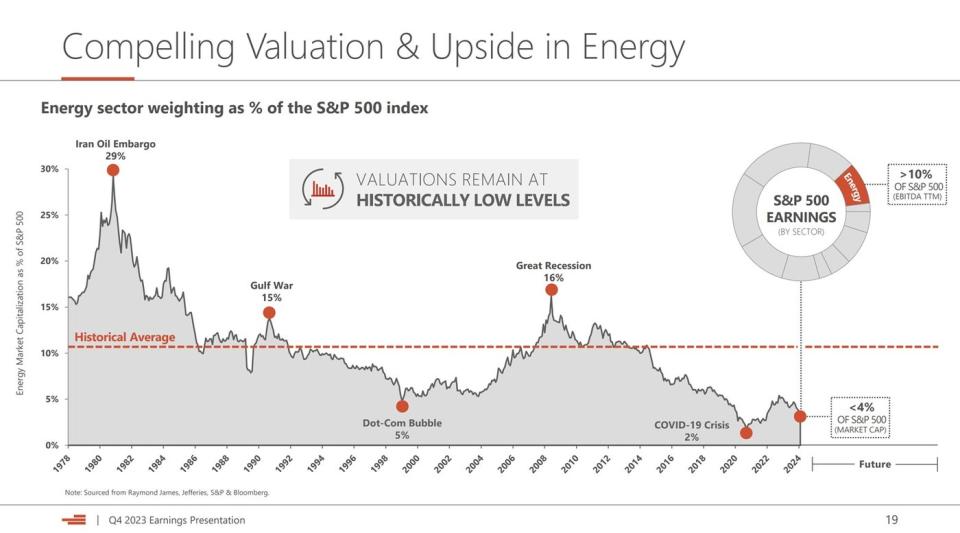

The energy industry currently has a historically low weighting in the S&P 500:

That chart shows that energy stocks make up less than 4% of the S&P 500 by market cap. That’s the second lowest level over the past few decades, including less than during the dot-com bubble. Because energy stocks supply 10% of the S&P 500’s earnings, the sector should have around a 10% weighting since it has historically tracked its earnings contribution. That would put it near the historical average.

Rick Muncrief, the CEO of oil and gas producer Devon Energy (NYSE: DVN), discussed the energy sector’s currently compelling value proposition on its fourth-quarter conference call. He commented on what’s likely driving the gap, stating, “I believe this gap exists due to extreme valuations in tech, combined with a pervasive misunderstanding of hydrocarbon demand over time.”

Whereas energy stocks have barely budged over the past year, tech stocks have rallied more than 50%, driving much of the S&P 500’s rebound. Many technology companies trade at extremely frothy valuations today, driven by the hype surrounding artificial intelligence. For example, the tech-heavy Nasdaq 100 currently trades at a forward P/E ratio of more than 30, while the S&P 500 sells for about 21 times forward earnings. Both indexes have seen significant multiple expansion over the past year. The Nasdaq 100’s P/E ratio was less than 25 a year ago, while the S&P 500’s was around 18.

The other factor weighing on energy stocks is the misplaced belief that demand…

2024-03-04 06:47:00

All news and articles are copyrighted to the respective authors and/or News Broadcasters. VIXC.Com is an independent Online News Aggregator

Read more from original source here…