Stocks, US futures decline before inflation gauge: Markets Wrap

2 min read

(Bloomberg) — European stocks and US futures dipped ahead of the release of a US inflation gauge that may help shape the outlook for Federal Reserve policy.

Most Read from Bloomberg

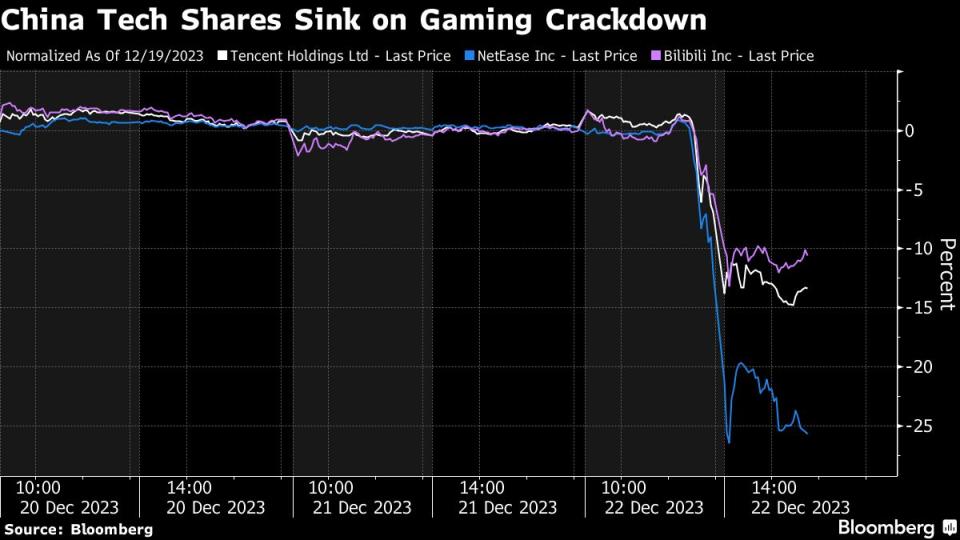

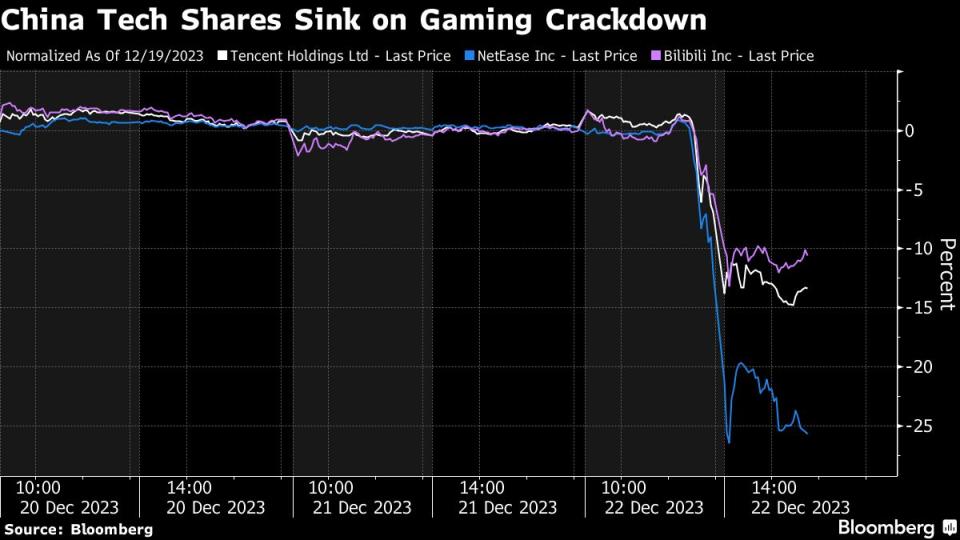

Technology stocks led a decline in the Stoxx Europe 600 index. Prosus NV plunged as much as 15% after China announced new curbs on online gaming, pummeling some of the region’s largest tech shares including Tencent Holdings Ltd. Adidas AG and Puma SE slumped after a weak sales outlook from US competitor Nike Inc. Delivery Hero SE fell more than 10% after announcing job cuts.

The US core personal consumption expenditures price index probably fell to 3.3% in November from 3.5% the previous month, according to a Bloomberg survey of economists before the numbers are released later Friday. That may bolster expectations of Fed rate cuts next year after data Thursday suggested the US economy is cooling.

“The focus today is on core PCE tonight and one should be mindful of the razor-thin liquidity heading into the festive season as data surprise may exacerbate price movement,” said Christopher Wong, a foreign-exchange strategist at Oversea-Chinese Banking Corp. in Singapore.

Swaps traders are pricing in around 150 basis points of Fed cuts next year, twice as much as the central bank has signaled as US GDP growth was revised lower Thursday to a 4.9% annualized reading in the third quarter. Personal consumption data also came in softer than economists had anticipated.

Treasury yields and the dollar were steady. Oil extended its biggest weekly gain in two months as shippers avoided the Red Sea amid increased attacks, while Angola’s exit from OPEC after 16 years put the spotlight on the group’s unity.

Nike’s shares fell more than 10% in late trading after the company said it’s looking for as much as $2 billion in cost savings by dismissing workers and simplifying the apparel giant’s product…

2023-12-22 03:21:39

All news and articles are copyrighted to the respective authors and/or News Broadcasters. VIXC.Com is an independent Online News Aggregator

Read more from original source here…