Super Micro Computer Fell Again Today — Is This an Opportunity to Buy 2024’s Most Explosive AI Stock?

2 min read

Super Micro Computer (NASDAQ: SMCI) stock slipped in Tuesday’s trading. The company’s share price closed out the daily session down 6.8%, according to data from S&P Global Market Intelligence. Notably, it had been down as much as 11.7% earlier in the day’s trading, but it bounced back as some investors bought into the sell-off.

While there wasn’t any business-specific news pushing Supermicro stock lower today, the server-and-storage technology company’s share price lost ground as Wall Street weighed potential macroeconomic risks. The trend impacted many high-profile artificial intelligence (AI) stocks with growth-dependent valuations, including Nvidia and AMD.

Before the market opened this morning, Home Depot published its fourth-quarter earnings results and set a bearish backdrop for the broader market. While the retailer may not seem to have much connection to AI stocks, the company’s performance and guidance is a bellwether for the U.S. economy.

Notably, Home Depot’s management said that persistent inflation was continuing to impact its performance. The home improvement retail giant indicated that headwinds could continue throughout the year. If inflation continues to run hot, the Federal Reserve will likely delay the interest rate cuts that investors have been anxiously awaiting. If so, that could be bad news for Super Micro Computer and other growth stocks.

Is Supermicro stock’s recent pullback a buying opportunity?

Even with recent sell-offs for the stock, Supermicro is still up 177% in 2024’s trading. Over the last year, the company’s share price has risen an incredible 757%.

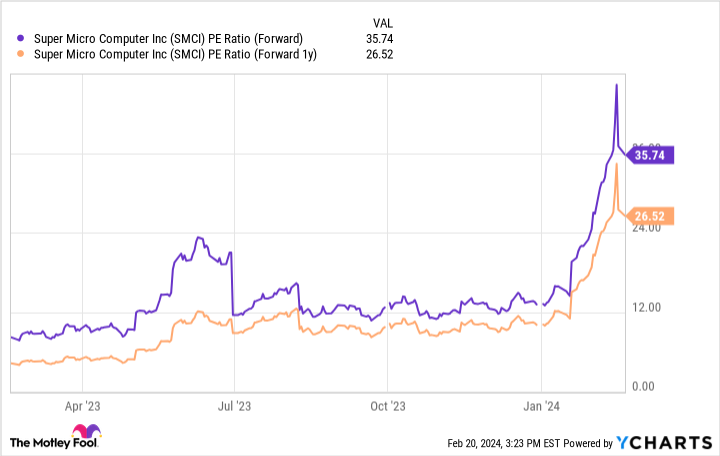

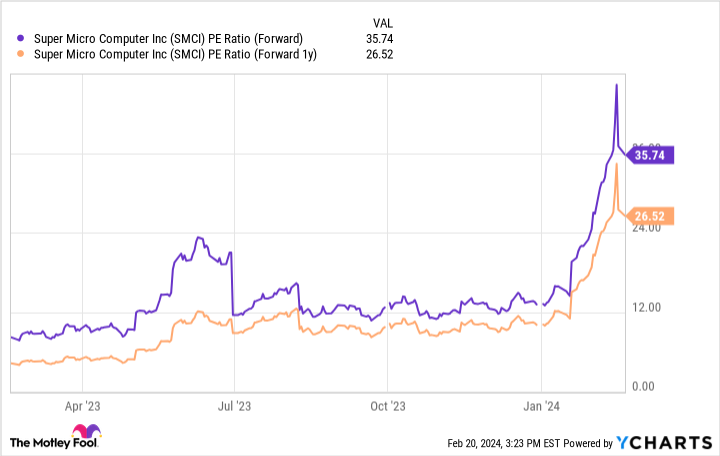

Even with dramatic improvements for the company’s performance outlook, explosive stock gains have had the effect of pushing the company’s valuation up to far more growth-dependent levels. Shares now trade at 26.5 times this year’s expected earnings and approximately 36 times next year’s expected profits.

Supermicro’s recent business momentum seems…

2024-02-20 16:40:43

All news and articles are copyrighted to the respective authors and/or News Broadcasters. VIXC.Com is an independent Online News Aggregator

Read more from original source here…