Super Micro Computer Jumped Again Today — Is It Time to Buy the Artificial Intelligence (AI) Stock Hand Over Fist?

2 min read

Super Micro Computer (NASDAQ: SMCI) stock climbed again Monday. The company’s share price closed out the daily trading session up 4.4%, according to data from S&P Global Market Intelligence. Earlier in the session, it had been up as much as 9.4%.

Before the market opened this morning, Northland Capital Markets published a bullish update on Super Micro. Analyst Nehal Chokshi’s note maintained an “outperform” rating on the stock and raised the firm’s one-year price target from $625 per share to $925 per share. Based on the server specialist’s stock price of roughly $773 per share at today’s market close, hitting Chokshi’s target would imply upside of approximately 20% over the next 12 months.

Is the red-hot AI stock a buy right now?

Super Micro Computer is a provider of high-performance servers and storage solutions. In conjunction with the rise of artificial intelligence (AI), the business has seen demand for its technologies soar.

In the second quarter of the company’s current fiscal year, which ended Dec. 31, Super Micro’s revenue more than doubled year over year to hit $3.66 billion. Meanwhile, non-GAAP (adjusted) earnings came in at $5.59 per share — up 71.5% compared to the prior-year period. The rapid-growth acceleration has helped push the stock up 759% over the last year.

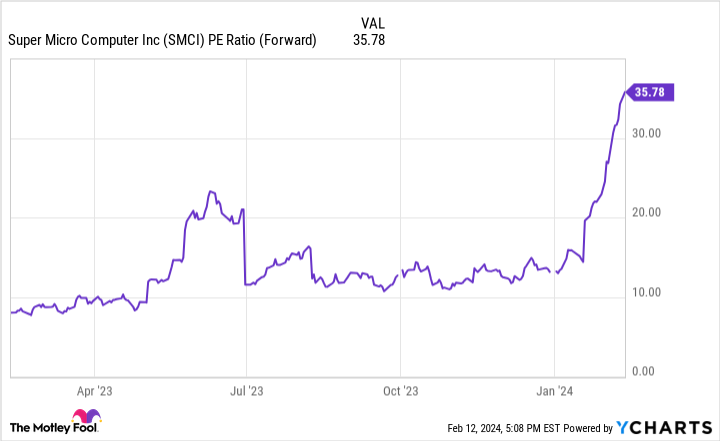

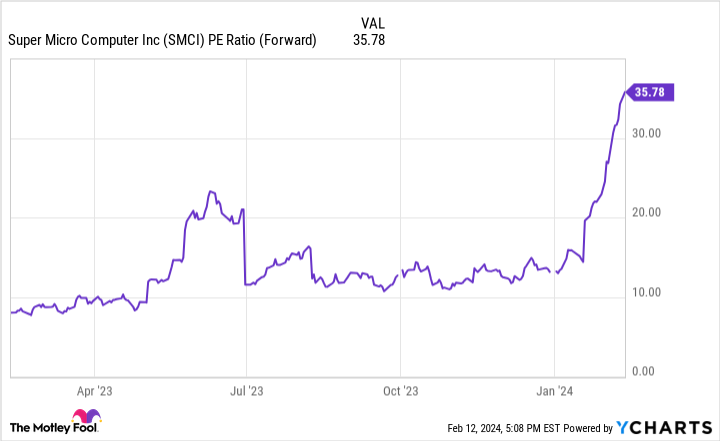

Super Micro is currently trading at roughly 35.6 times this year’s expected earnings. Jump ahead to its next fiscal year, and the average-analyst estimate expects the business to record earnings of $27 per share — working out to a forward price-to-earnings ratio of 28.6.

The company’s valuation has become substantially more growth-dependent in conjunction with the recent run-up for the stock, but it’s not necessarily unwarranted. With AI taking off, Super Micro is winning business in an important technology category.

Admittedly, it’s hard to predict exactly what the company’s business trajectory will look like over the long term, but the recent surge in demand for…

2024-02-12 18:20:00

All news and articles are copyrighted to the respective authors and/or News Broadcasters. VIXC.Com is an independent Online News Aggregator

Read more from original source here…