The Fed pausing rate hikes has been a reliable stock-buying signal for 40 years — but this time may be different

2 min read

-

The Fed pausing rate hikes has been a reliable buying signals for stocks for 40 years, Barclays said.

-

An expected Fed pivot to rate cuts next year will fit the pattern.

-

But Wall Street could be too optimistic about a rally this time around, analysts said.

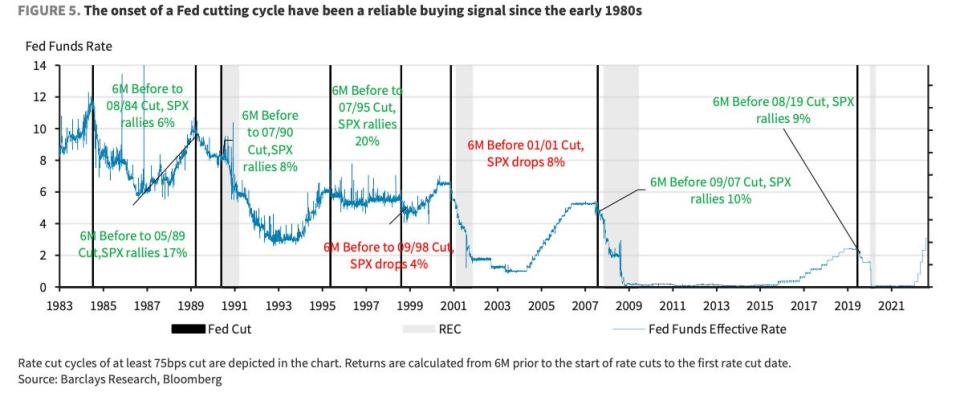

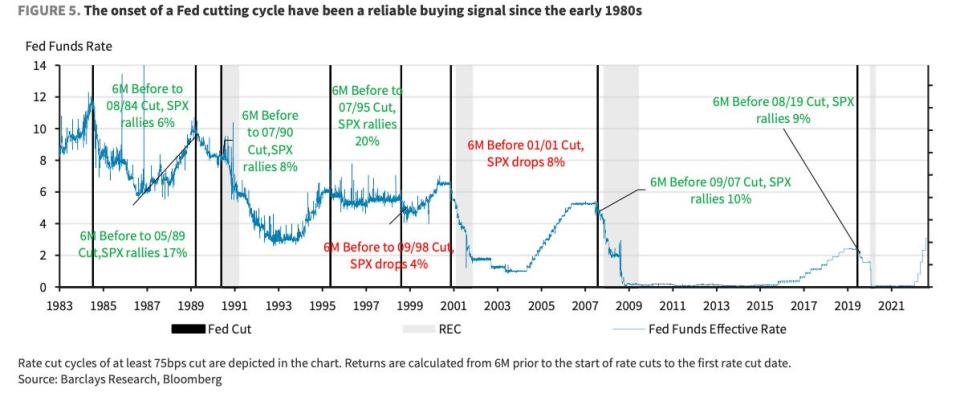

A dovish turn in monetary policy has long been a solid bull signal for stocks, often paving the way for equities to reach new market highs, Barclays said in a note.

In the past 40 years, the time between the last Federal Reserve rate hike and an eventual recession has almost always led the S&P 500 to hit an all-time high. Only in 2001 did the trend fail, though the index still rose 11%.

With the Fed’s July rate hike now looking like its final one of the tightening cycle, the pattern looks like it’s about to repeat itself. Meanwhile, markets have surged on hopes a pivot to rate cuts is coming next year. But Barclays is cautious.

“This cycle is decidedly different than any we have experienced for the last several decades, due to the overhang of high inflation,” analysts said.

In the past, the Fed has been able to pause rate hikes well before a recession arrives, paving the way for fresh stock market highs before the eventual downturn, they explained.

But in periods when the central bank was trying to bring down high inflation, the span between a Fed pause and a recession tends to shrink, sometimes even overlapping.

If that’s the case today, it could spell trouble for stocks, Barclays warned.

“If a recession were to materialize, past periods suggest significant additional downside from here,” it said. “Strong jobs data remains the key holdout among otherwise weakening leading indicators, but we see signs that this may be approaching an inflection point.”

Still, Barclays acknowledged that the economy’s surprising resilience for now brings the current cycle more in line with those bullish patterns over the past 40 years.

“The recession that was…

2023-12-20 21:38:00

All news and articles are copyrighted to the respective authors and/or News Broadcasters. VIXC.Com is an independent Online News Aggregator

Read more from original source here…