This Could Make or Break Carnival Corp.’s Year in 2024

2 min read

Last year was one of recovery for Carnival Corp. (NYSE: CCL)(NYSE: CUK). The cruise line operator benefited from a resurgence in travel as it posted record numbers. Shares of the company rose by 130% last year as a result.

But will that remain the case in 2024? Although business has been good, Carnival Corp. is carrying an awful lot of debt. And the key to bringing it down this year is generating ample free cash flow. If the company does that, it could result in another strong year for the travel stock.

Why free cash flow will be important to Carnival Corp.

Free cash flow is a company’s operating cash flow after deducting capital expenditures. It tells investors how much cash the company has available to reinvest in its operations for further growth, pay dividends, or pay down debt. It’s arguably just as important, if not more so, than accounting profits, which factor in noncash expenses.

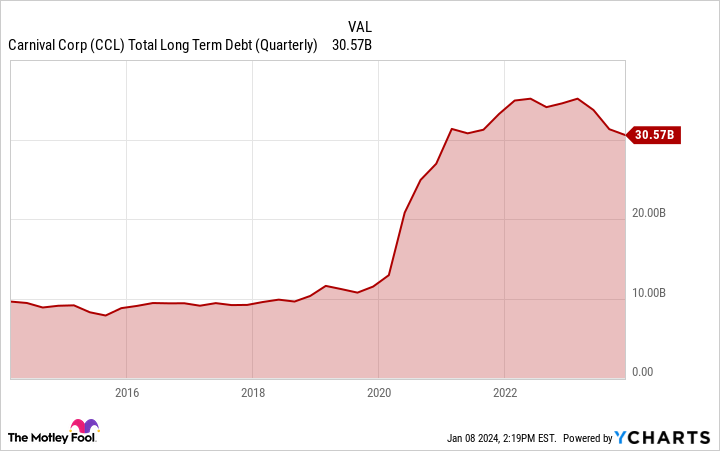

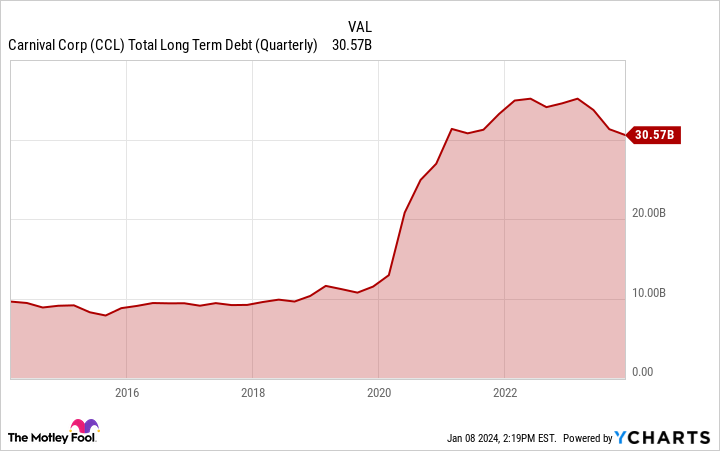

During the early stages of the pandemic and amid travel restrictions, cruise ship companies struggled, and Carnival was no exception. As a result of the challenging economic conditions, Carnival had to resort to taking on additional debt, and it now carries significantly more of it than it needed to in the past.

The above chart suggests there’s a mountain of debt for Carnival Corp. to pay down, which it has begun. But a key metric in determining how quickly the cruise operator will be able to do so is free cash flow; the more cash that it has available to put to use, the quicker it can extinguish some of that debt. As of Nov. 30, 2023, the company’s current and long-term debt totaled $30.6 billion — down from $34.5 billion a year earlier.

Although the company has been making progress, Carnival’s high debt load is likely a key reason investors aren’t more bullish on the stock; Carnival’s shares were trading higher than $40 before the pandemic, while today, they struggle to hit the $20 mark.

Free cash flow is back to pre-pandemic levels

One thing that is back to pre-pandemic levels for…

2024-01-11 09:17:00

All news and articles are copyrighted to the respective authors and/or News Broadcasters. VIXC.Com is an independent Online News Aggregator

Read more from original source here…