Warren Buffett’s Berkshire cuts stocks for fourth straight quarter

2 min read

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Warren Buffett’s Berkshire Hathaway continued to sell off stakes in publicly traded companies, shedding more than $5bn of exposure to US and foreign stocks in the third quarter as the firm struggled to find appealing investments in a volatile market.

The sales mean the sprawling conglomerate has sold stocks for four straight quarters, with divestments approaching $40bn. It has cut positions in companies such as oil major Chevron, automaker General Motors and insurer Marsh & McLennan.

The value of Berkshire’s stock portfolio shrank to $319bn from $353bn at the end of June, a decline fuelled by the slide in the broader market as investors came to believe that the Federal Reserve would keep interest rates higher for longer.

That has weighed on the valuations of publicly traded companies and prompted some portfolio managers to search for better returns in fixed income markets.

Buffett’s investment shifts are closely followed by fund managers and the wider public for clues as to where the 93-year-old investor sees attractive returns.

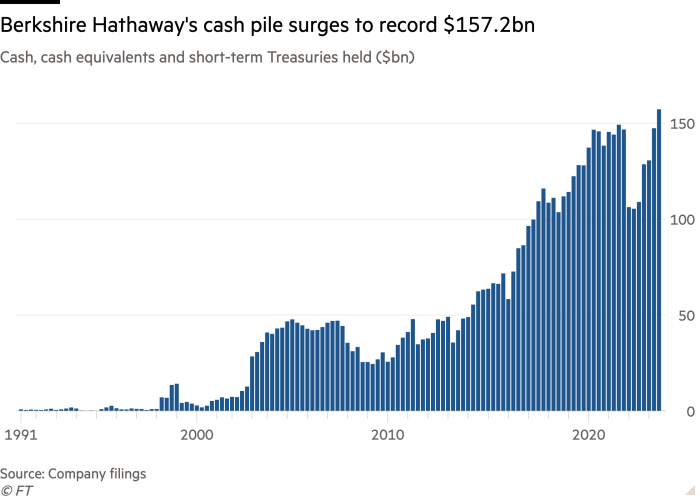

He directed the proceeds of those stock sales, as well as the cash flows Berkshire’s many businesses generated, into cash and Treasury bills. The company’s cash pile surged nearly $10bn to a record $157.2bn at the end of September, a sum that gives it formidable firepower for acquisitions.

Berkshire has been one of the big beneficiaries of rising interest rates, which in the US climbed above 5 per cent this year. The company disclosed that the interest income it was earning on its insurance investments climbed to $1.7bn in the quarter, lifting the sum to $5.1bn over the past 12 months. That eclipsed the total interest Berkshire earned on its cash reserves in the preceding three years combined.

Buffett disclosed that the company repurchased $1.1bn worth of Berkshire stock in the quarter, down from the $1.4bn it…

2023-11-04 10:02:41

All news and articles are copyrighted to the respective authors and/or News Broadcasters. VIXC.Com is an independent Online News Aggregator

Read more from original source here…