Will Palantir Technologies Be a Trillion-Dollar Stock by 2035?

2 min read

What’s the most exclusive club on Wall Street? I’d argue it’s the trillion-dollar club, a group of six stocks, each boasting a valuation above $1 trillion: Microsoft, Apple, Nvidia, Alphabet, Amazon, and Meta Platforms.

By 2035, the club will likely expand significantly, with companies across a broad range of sectors topping the $1 trillion mark. So, let’s examine one that may have the potential to hit a valuation of $1 trillion by 2035: Palantir Technologies (NYSE: PLTR).

How Palantir stacks up today

Let’s start with how large it is now to figure out how much Palantir’s valuation could go. As of this writing, Palantir has a market cap of $51.6 billion. The company ranks as the 350-largest American company.

Needless to say, Palantir has a long way to go if it wants to crack the $1 trillion club. The company would need to grow nearly 2,000% or 20x by 2035. That works out to a Compound Annual Growth Rate (CAGR) of about 32%. Interestingly, Palantir has generated a CAGR of 31% since debuting via an Initial Public Offering (IPO) in 2020.

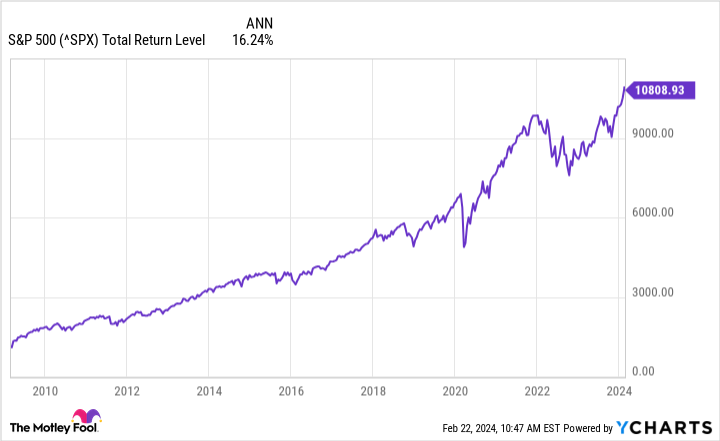

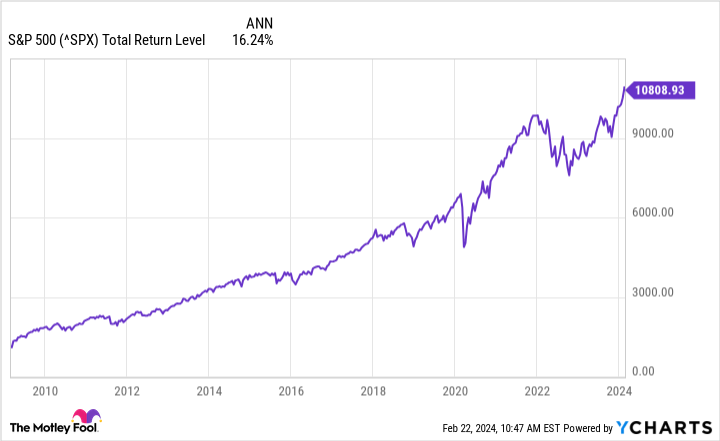

Such a growth level might seem unachievable for a longer time span. After all, if you look at a benchmark index, like the S&P 500, its lifetime total return CAGR, which stretches back over 70 years, is only 10%. Even if you choose shorter, more bullish periods, the S&P 500’s CAGR improves but still falls well short of 30%.

For example, between March 2009 and today — overall, a very bullish period in the stock market — the S&P 500’s CAGR is only 16%.

However, the S&P 500, like all stock market indexes, has less volatility than individual stocks. If we examine stocks one by one, it becomes clear that hitting and maintaining a 30% CAGR is possible.

As you can see in the chart below, Advanced Micro Devices, Microsoft, and Tesla all achieved a CAGR equal to or greater than 28% over the last decade. AMD, for one, has a 10-year CAGR of 46%. Many of these high-growth rates stem from the…

2024-02-24 10:45:00

All news and articles are copyrighted to the respective authors and/or News Broadcasters. VIXC.Com is an independent Online News Aggregator

Read more from original source here…